0 coupon bond formula|Zero : Clark To calculate the price of a zero-coupon bond—i.e. the present value ( PV )—the first step is to find the bond’s future value (FV), which is most frequently $1,000. . SEATTLE — Independent producers Lady Olivia and Laz Fyre have released two new scenes on their official website, HouseOFyre.com. Ella Hughes joins the Fyre team for a POV-style threesome scene titled, "Reluctant Tutor Earns Her Bonus." The scene features Hughes as the aforementioned reluctant tutor who can’t get her student, .

PH0 · Zero Coupon Bond Value

PH1 · Zero Coupon Bond

PH2 · Zero

PH3 · What are Zero

PH4 · Value and Yield of a Zero

PH5 · How to Calculate Yield to Maturity of a Zero

Sesuai permintaan, kami dapat menghapus link ke konten dari hasil penelusuran Google jika konten tersebut ada di situs yang mengharuskan orang membayar uang secara langsung ke situs tersebut atau agen

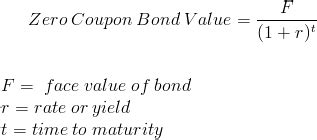

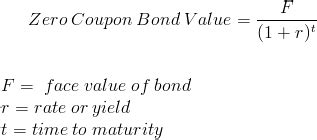

0 coupon bond formula*******The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r)n where: 1. M = Maturity value or face value of the bond 2. r = required rate of interest 3. n = number of . Tingnan ang higit paA zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, . Tingnan ang higit paSome bonds are issued as zero-coupon instruments from the start, while other bonds transform into zero-coupon instruments after a financial institution strips them of their coupons, and repackages them as zero-coupon bonds. Because . Tingnan ang higit paA zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills .

To calculate the price of a zero-coupon bond—i.e. the present value ( PV )—the first step is to find the bond’s future value (FV), which is most frequently $1,000. .

A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at . What is Zero Coupon Bond? Zero-Coupon Bond, also known as Pure Discount Bond or Accrual Bond, refers to those bonds which are issued at a discount to their par value and makes no . The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond. Zero-coupon bonds pay no interest and are issued at a discount to face value. Investors profit by buying them below par, and they receive the full face value at maturity. Common Zero-coupon .

A zero-coupon bond (also called a zero) is a bond which pays no coupon payments. Its yield results from the difference between its issue price and maturity .Zero A zero-coupon bond (also called a zero) is a bond which pays no coupon payments. Its yield results from the difference between its issue price and maturity .What are Zero-Coupon Bonds? A zero-coupon bond is a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, . Zero-Coupon Bond Value Formula. M = maturity value or face value of the bond; r = rate of interest required; n = number of years to maturity; Face Value is .A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. With all the inputs ready, we can now calculate the coupon rate by dividing the annual coupon by the par value of the bonds. Coupon Rate (%) = $50,000 ÷ $1,000,000 = 5%. Therefore, the bond is priced at a coupon rate of 5% on a $1 million par value, resulting in two semi-annual payments of $25,000 per year until the bond .

0 coupon bond formula Zero Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, . Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's . Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face .

0 coupon bond formula Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face . As for our last input, we multiply the semi-annual coupon rate by the face value of the bond to arrive at the semi-annual coupon of the bond, i.e. the semi-annual interest payment. Semi-Annual Coupon (C) = 3.0% × $1,000 = $30; 3. Yield to Maturity Calculation Example (YTM) A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

Formula Breakdown. PV(C6,C7,0,C5) → The PV function calculates the present value of a loan or investment based on a constant interest rate.; C6 is the rate, which is referred to as Yield to Maturity (YTM); C7 is the nper, which is the total number of payment periods; 0 is the pmt, that is the payment made on each period.For zero .

Jellyneo.net provides Neopets users with game guides, helpful articles, solutions and goodies to guide your Neopets experience. With over 800 pages of quality content, you can't go wrong with Jellyneo!T o meet the needs of people learning English, Reverso offers a free English dictionary that goes far beyond what a normal monolingual dictionary or thesaurus can provide by explaining the use of words and phrases in natural language and providing real-life examples. This English dictionary for learners features definitions written in language .

0 coupon bond formula|Zero